Little Known Questions About Clark Wealth Partners.

Table of ContentsIndicators on Clark Wealth Partners You Need To KnowThe Facts About Clark Wealth Partners Revealed10 Simple Techniques For Clark Wealth PartnersFascination About Clark Wealth PartnersTop Guidelines Of Clark Wealth PartnersSome Known Incorrect Statements About Clark Wealth Partners A Biased View of Clark Wealth Partners

The world of financing is a difficult one. The FINRA Foundation's National Capability Research Study, as an example, just recently discovered that virtually two-thirds of Americans were unable to pass a fundamental, five-question monetary literacy examination that quizzed participants on subjects such as rate of interest, financial obligation, and other reasonably fundamental concepts. It's little marvel, then, that we often see headlines lamenting the inadequate state of a lot of Americans' finances (retirement planning scott afb il).Along with managing their existing clients, financial experts will frequently invest a reasonable amount of time every week conference with potential clients and marketing their services to retain and expand their business. For those thinking about ending up being an economic advisor, it is necessary to think about the ordinary wage and work stability for those operating in the field.

Programs in taxes, estate preparation, financial investments, and danger administration can be valuable for students on this course. Depending on your special occupation goals, you may also need to gain certain licenses to accomplish specific clients' requirements, such as buying and selling stocks, bonds, and insurance coverage. It can also be useful to earn a certification such as a Qualified Monetary Planner (CFP), Chartered Financial Expert (CFA), or Personal Financial Expert (PFS).

The Best Strategy To Use For Clark Wealth Partners

Many individuals decide to get help by using the solutions of a financial professional. What that looks like can be a variety of points, and can vary depending on your age and phase of life. Prior to you do anything, research is key. Some people worry that they need a certain amount of cash to invest before they can obtain aid from a specialist.

Getting The Clark Wealth Partners To Work

If you have not had any kind of experience with a monetary advisor, below's what to anticipate: They'll begin by offering a complete analysis of where you stand with your assets, responsibilities and whether you're meeting standards contrasted to your peers for savings and retired life. They'll assess short- and lasting goals. What's helpful regarding this step is that it is customized for you.

You're young and functioning complete time, have an automobile or 2 and there are trainee financings to pay off.

Clark Wealth Partners Can Be Fun For Everyone

You can go over the following best time for follow-up. Before you start, inquire about rates. Financial experts generally have different tiers of pricing. Some have minimal possession levels and will bill a cost generally several thousand dollars for producing and adjusting a plan, or they may charge a flat fee.

You're looking ahead to your retirement and aiding your kids with higher education and learning expenses. An economic consultant can supply advice for those circumstances and more.

See This Report on Clark Wealth Partners

That might not be the finest means to maintain building wealth, specifically as you progress in your career. Arrange regular check-ins with your organizer to modify your plan as required. Balancing cost savings for retirement and college prices for your children can be challenging. A monetary advisor can aid you prioritize.

Assuming around when you can retire and what post-retirement years might look like can create issues concerning whether your retirement savings remain in line with your post-work strategies, or if you have saved sufficient to leave a tradition. Assist your economic professional recognize your strategy to cash. If you are a lot more conventional with conserving (and possible loss), their tips should react to your worries and issues.

How Clark Wealth Partners can Save You Time, Stress, and Money.

For instance, preparing for healthcare is one of the huge unknowns in retired life, and an economic expert can describe options and suggest whether additional insurance as security may be practical. Prior to you begin, try to get comfortable with the concept of sharing your whole economic picture with an expert.

Offering your professional a full picture can aid them produce a strategy that's focused on to all components of your economic standing, specifically as you're quick approaching your post-work years. If your finances are basic and you have a love for doing it on your own, you may be fine on your very own.

An economic consultant is not just for the super-rich; any person encountering significant life shifts, nearing retired life, or feeling bewildered by economic choices can benefit from specialist assistance. This article checks out the role of monetary consultants, when you may need to get in touch with one, and essential factors to consider for choosing - https://www.callupcontact.com/b/businessprofile/Clark_Wealth_Partners/9883120. A financial consultant is a trained professional that assists customers manage their finances and make informed choices that align with their life goals

About Clark Wealth Partners

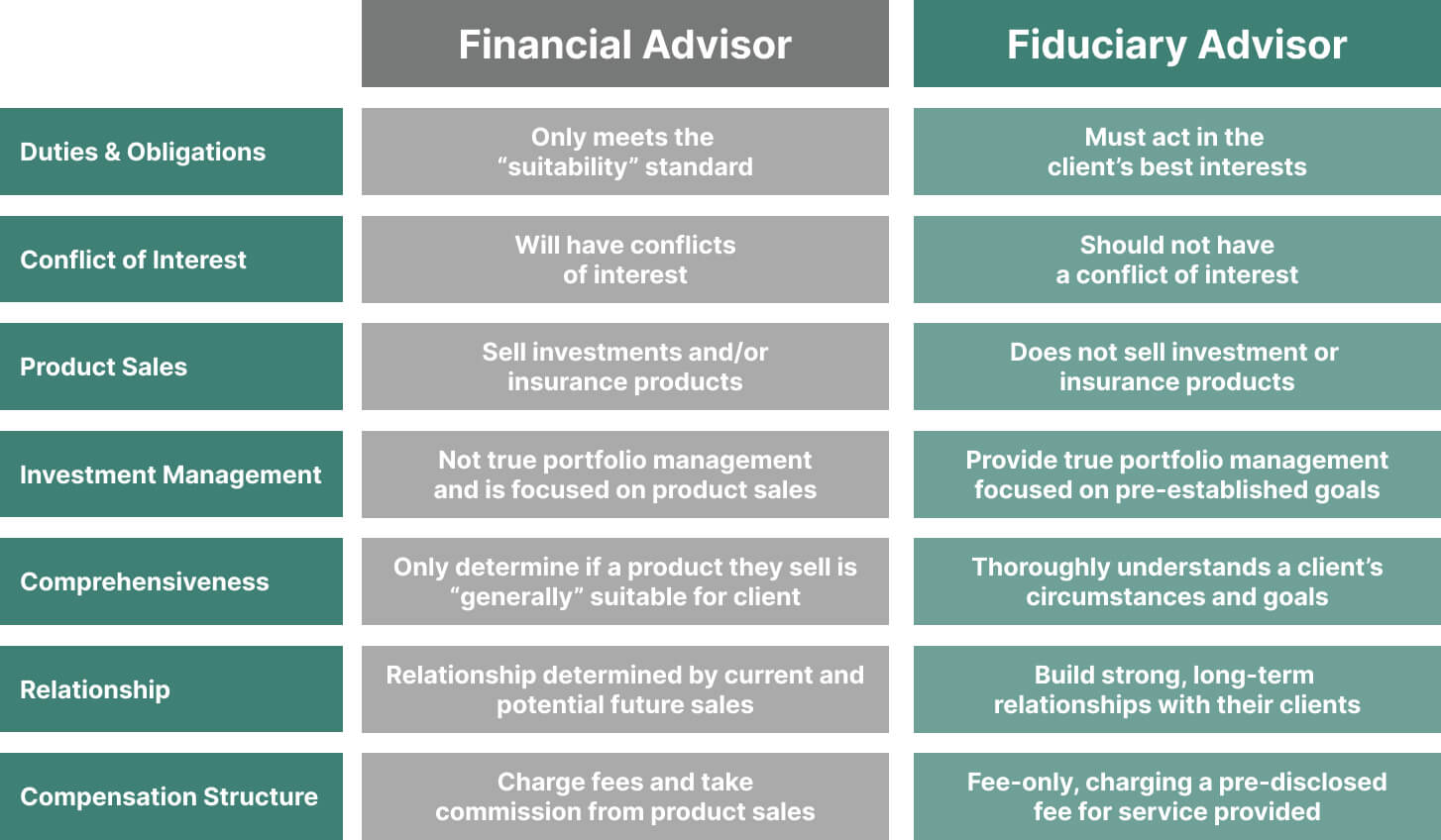

Payment models additionally differ. Fee-only advisors charge a level charge, hourly rate, or a percent of properties under management, which has a tendency to lower prospective conflicts of interest. In contrast, commission-based advisors gain income with the monetary products they sell, which might affect their suggestions. Whether it is marital relationship, divorce, the birth of a child, profession changes, or the loss of an enjoyed one, these occasions have unique monetary implications, often calling for timely choices that can have long-term results.